Economic Collapse

Quote of the Day

"Henry Ford was right. A prosperous economy requires that workers be able to buy the products that they produce. This is as true in a global economy as a national one." - John J. Sweeney

The world economy is collapsing...who can argue against this statement? Let's look at the definition of collapse...

Collapse:1. to fall or cave in; crumble suddenly 2. to be made so that sections or parts can be folded up, as for convenient storage 3. to break down; come to nothing; fail

From: Investopedia: Definition of 'Economic Collapse'

A complete breakdown of a national, regional or territorial economy. An economic collapse is essentially a severe version of an economic depression, where an economy is in complete distress for months, years, or possibly even decades.

A total economic collapse is characterized by economic depression, civil unrest and highly increased poverty levels. Hyperinflation, stagflation and financial-market crashes can all be causes. Government intervention is usually necessary to bring an economy back from collapse, but can often be slow to remedy the problem.

The economy certainly meets all the criteria; there has certainly been a complete breakdown, not only in national, regional, or territorial economics but in the world's economy. The economy has certainly been in distress for not only months, but for years. We are most certainly seeing economic depression, civil unrest is without doubt increasing, and poverty levels are going through the roof. You would have to say the economy has broken down, the economy has come to nothing, and in other words it has failed.

Furthermore, it is for sure the governments of the world have definitely intervened. However, instead of providing a remedy, the governments help has been to the detriment of the economy.

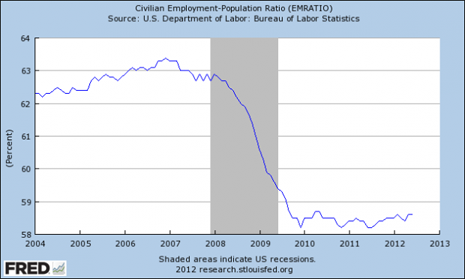

Without one word of explanation, Harvard University Econ Professor Greg Mankiw posted the following graph to his blog:

Does this chart look like a recovery?

Looking at the unemployment situation...today over 14 million are unemployed. We have more people unemployed than at any other time since the Great Depression. There are a 130,000,000 people employed in the U.S. today, this is the same number as were employed in 2000, yet there are 30 million more people in the U.S. today than in 2000. Keep in mind these figures do not include illegals.

Note: You must keep in mind most if not all the figures on unemployment and housing released by the government, lending institutions, and real estate concerns are skewed to make them seem better than they actually are. For instance 14 million is the official number of unemployed the actual number of unemployed is 23,044,369.

Now, to put these figures in perspective...In 1990 there were 191,829,271 people over 16 years old in the U.S. In 2000 there were 217,168,077 people over 16 or an increase of 25,338,806 people in the labor market. From 1990 to 2000 there was an increase of 14,040,310 net jobs created. This compares to the zero net jobs created from 2000 to 2012. That looks like zero growth in those twelve years.

You may be wondering how job loss in the 2007 to 2009 recession compares to other recession. Not very well, this is shown in the following chart.

| Duration | Jobs Lost |

|---|---|

| Jan. 1980 to July 1980 | 968,000 |

| July 1981 to Nov 1982 | 2,824,000 |

| July 1990 to March 1991 | 1,249,000 |

| March 2001 to Nov 2001 | 1,599,000 |

| Dec 2007 to June 2009 | 7,490,000 ("Great Recession") |

About 850,000 more jobs were lost during the great recession than in the previous four recessions combined.(Notice these figures are only up to 2009)

Everyone is pointing to the rise in housing starts as an indicator of economic recovery. As a matter of fact one article even went so far as to say " the home construction is what brought the economy down and now it looks like home construction may bring the economy back...Really...let's look at this in more detailed.

It is true that housing starts did increase...from a 516,000 units annual rate to 760,000 units annual rate. (seasonally adjusted projections not actual numbers) However looking at the average housing starts before the crash, from 2000 to 2007, the annual average single family housing starts was almost 1,500,000 units per year or double what we see now. Is this what we now call a recover?

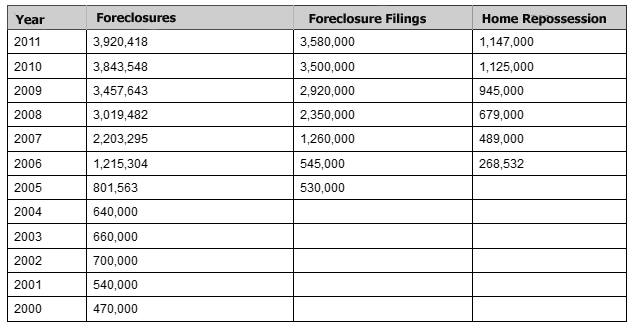

Source: RealtyTrac, Federal Reserve,Equifax

Now, let's look at the home foreclosures. Looking at the chart above you can see we are a long way from recovery. The government as well as the real estate companies and loaning institutions recently announced that the rate of foreclosures has slowed. This sounds good, however this is another attempt to skew the facts and make something look better than it actually is. While it is true the rate of increase is slowing, the numbers of foreclosures are increasing.

As you can see from 2000 to 2005 there were 3,811,563 foreclosures. In the same period of time, from 2006 to 20011 there have been 17,659,690 home foreclosures. Recently released projection for 2012 show we are on track to surpass 4 million foreclosures. Recovery, I don't think so.

Summary

• National Debt................................................$15,862,600,000,000

• Total per tax payer.........................................$140,000.00

• GDP................................................................$15,265,892,000,000

• Actual Unemployed.......................................23,000,000

• Homes foreclosure since 2006......................17,000,000

Facts:

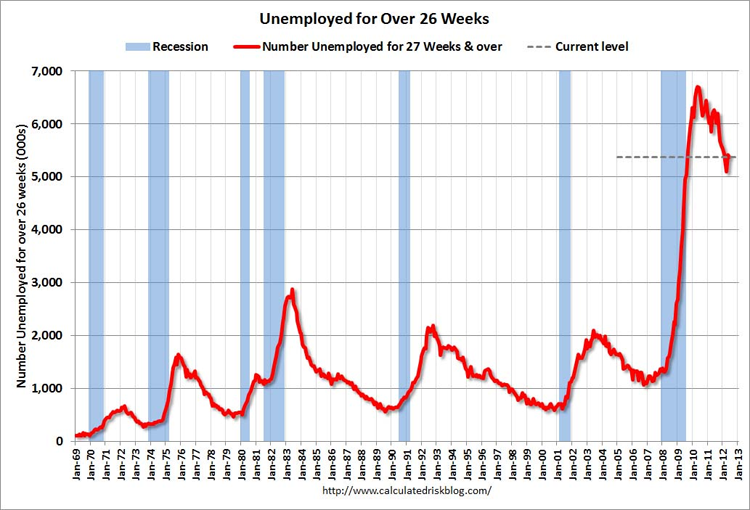

• Long term unemployed (27 plus weeks) 5.4 million or 41.9% of total unemployed.

• More people unemployed than at any time since the Great Depression.

• Zero net jobs created since 2000. In other words, the same number of people are employed today as there was in 2000...130,000,000

• Housing starts in 2012 project to be 750,000 units. Less than half as many units as averaged before the recession.

• Poverty rate projected to be 15.7 % or the highest since 1960.

• In 1970, 1 in every 50 people received food stamps. Today 1 in 7 receives food stamps. Just since 2008 number of people receiving food stamps has doubled.

• The projected average price per gallon for gasoline 2000...$1.60 Projected average per gallon 2012...$3.71.

National Debt:

• 9/30/1997......................................................$5,413,146,000,000

• 9/30/2000......................................................$5,674,000,000,000

• 9/30/2008......................................................$10,024,724,000,000

• 7/20/2012......................................................$15,874,409,000,000

Note: The last five years the national debt has increased over 1 trillion dollars a year.

GDP:

Let's now look at the history of the GDP and the National Debt. I think this is pretty telling as to where we have been and where we are going.

| Year | National Debt | GDP |

|---|---|---|

| 1930 | $16 Billion | $97.2 Billion |

| 1970 | $381 Billion | $1.3 Trillion |

| 2011 | $15.5 Trillion | $15.5 Trillion |

A couple of things jumped out at me, in 1930 our GDP was 6.5 times our National Debt, in 1970 GDP was 3 times our National Debt and in 2011 GDP is the same as our National Debt. From 1930 to 1970 the national debt grew $365 billion and from 1960 to 2011 it grew a little over $15 trillion.

According to U.S. Rep. Rodney Frelinghuysen, the United States is increasing its debt twice as fast as its economy is expanding. Rep. Frelinghuysen cited growth in debt compared with the increase in the gross domestic product, or GDP -- a measure of the nation's economy -- in the first quarter of 2012 and said, "The U.S. is borrowing approximately $2.52 for every $1 of economic growth so far in 2012."

If I remember right back in 2008 we were told, by both parties and a lot of economic professionals, that if Congress failed to approve the economic stimulus bill the country and possibly the world would go into recession or worse the economy would crash. February 13, 2008 the Economic Stimulus Act, was sign by the President. The country then went into what is known as the "Great Recession."

Following the Economic Act in 2008 we had the "American Recovery and Reinvestment Act of 2009." The Act was to cost the U.S. tax payer $787 billion, since that time it has been determined that the act will actually cost the tax payers well over a trillion dollars.

Since the economy is still in what could be termed a free fall I guess few people would say the stimulus acts could be considered a success. What would have been the results if there had been no stimulus acts? No one knows, what is known is we were told that the Acts would avert a recession and crash. Well, it didn’t stop the recession and all indications are the economy is in collapse mode.

Back in 2008 we were told by the government and economic professionals that if things did not improve the economy would collapse. As you have seen things today are much worse than they were in 2008. So does this mean we are in economic collapse, I certainly think so. I believe we are in an irreversible economic collapse. The big question is how far will the economy crash and how fast. This is anyone's guess. Personally, for what it is worth, I think the collapse will be extremely bad leading to a cascading effect, causing anarchy and a complete collapse of our society. As far as how fast this will happen, again my personal opinion is that it will happen relatively fast. It will be like a snow ball rolling down a hill, the further it rolls the faster and bigger it will get. Am I talking about Armageddon?.......no, life will continue but nothing resembling the life we have been living. I think most of us living today will see this come to fruition.

One thing for sure, life as we have known it is over, our children will not have the life we have had. This is already obvious. All of our lives have changed since 2008.

The economy is not the only Catastrophic Event we face today. It is simply the one I chose to highlight. There are many dangers both natural and manmade that we now face. I provide detailed information on all of the dangers in "Why Prepare to Survive?".